THE latest non-farm payrolls - 295,000 jobs were added in February, while the unemployment rate fell to 5.5% - will reassure investors about the health of the US economy, while simultaneously provoking concerns about the likely date of the first Federal Reserve rate increase.

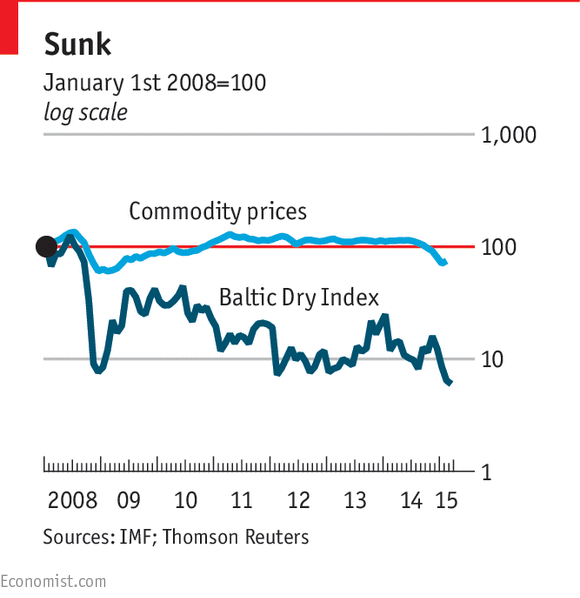

But what about the global economy? There are four things that might give investors pause. The first is the direction of central bank policy. The Fed might be thinking of pushing up rates but many more central banks have been cutting; India and Poland were the latest to join the trend. That doesn't suggest confidence in a global recovery. The second is bond yields. Euro zone 10-year yields are now on a par with their Japanese equivalents at 0.38%; the US has the highest yields in the G7 at 2.2%. Of course, one can argue that these yields have been manipulated by central banks, although both the Fed and the Bank of England reduced or stopped QE a while ago. The third and fourth measures are commodity prices and the Baltic Dry index, a measure of shipping rates (see chart, which is on a log scale). Both dipped in 2008-2009 and recently but the Baltic Dry's decline is much more precipitous; it recently hit a 30-year low.

One would expect there to be some kind of link between the two. After all, commodities are exactly the kind of product - bulky, imperishable - that companies are going to send by ship. And these indices are, of course, driven by the balance of supply and demand. Commodity markets operate with a lag - it takes time to develop new oil fields and dig new mines - so the risk is that the price may have dropped by the time the extra supply comes on stream. Shipping operates with an extra lag since shipowners respond to higher commodity demand. New ship orders more than trebled between 2012 and 2013. But it may not be just supply that is to blame; the WTO has been cutting its forecasts for world trade growth.

The head of Maersk, the shipping group, recently talked of slower global trade growth, adding that

The economies in Europe are still very sluggish. Brazil, Russia and China: those three economies used to drive a lot of growth, and right now we are not really seeing that to the same extent. The only real bright spot is the US, and even the US is good but not great

One should be pretty cautious about overinterpreting the Baltic Dry's movements; its sheer volatility over the long term suggests it can hardly be an exact forecaster of the economy. In some respects, its fall may even be good news, as some commenters point out. However the index's slump hardly suggests a boom either. And another bellwether isKorean exports which fell 3.4% year on year in February (although seasonal factors played their part).

The big question is whether lower oil prices and interest rate cuts will eventually act to give the economy a second wind, or whether both developments are merely a symbol of incipient weakness. The equity markets clearly favour the benign interpretation, and indeed one can partly explain rate-cutting and low bond yields with respect to the effect of falling commodity prices on inflation. As always, we need more data; first quarter GDP numbers from the emerging markets (out next month) will be the next test.

Source: Economist