The container-shipping industry has been highly unprofitable over the past five years. Making things worse, earnings have been exceptionally volatile. Several factors are responsible, notably trade’s spotty recovery from the global financial crisis, and redoubled efforts by corporate customers to control costs. Some of the pain is self-inflicted: as in past cycles, the industry extrapolated the good times and foresaw an unsustainable rise in demand. It is now building capacity that appears will be mostly unneeded.

These problems are real and significant, and largely beyond the power of any one company to address. But shipping companies cannot afford to throw up their hands and accept their fate. Hidden beneath these issues (and driving them to a degree) is another set of challenges that shipping lines can readily take on. Across the enterprise, in commercial, operations, and network and fleet activities, shipping lines have opportunities to improve performance. In sales, for example, carriers often confuse their costs with the value received by customers and fail to charge a premium for services for which shippers will pay more. In operations, many lines treat bunker as just another cost of doing business. In fact, fuel presents many opportunities, not just in procurement, but also in consumption. In network design, more than a few shipping companies use outmoded approaches to design their routes; new and more powerful systems use algorithms to make better, more effective decisions about networks.

With a little bit here and a little bit there, companies that take on a full program of initiatives can boost earnings by as much as 10 to 20 percentage points—enough to reverse the recent trend, and return to profit. To realize that kind of upside, however, firms must also ready their organizations for change. That’s a nontrivial challenge: in many ways, very little has changed in container shipping since the first crane hoisted the first box in 1956. Companies need to find ways to help employees embrace new ways of working and must be prepared to bet on the future. Carriers that embrace change will be better prepared than their rivals to make the best of the current business cycle and to thrive in the next one.

The industry’s bleak economics

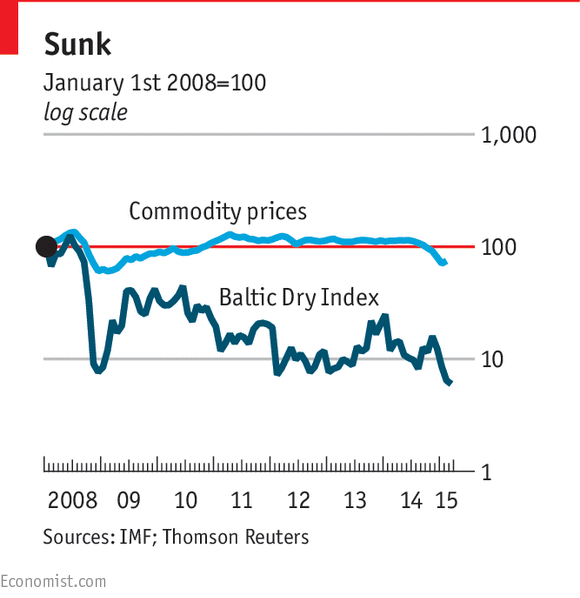

Transport is often seen as the harbinger of the broader economy. It certainly fulfilled that role in the recent economic crisis, as business fell off precipitously. However, shipping is now also a kind of lagging indicator: its performance is trailing the broader, somewhat erratic global recovery.

A big part of the problem is that the industry continues to add capacity. By 2015, the typical vessel delivered will handle about 10,000 20-foot equivalent units (TEU), five times more than ships built in the 1990s. Not surprisingly, pressure to fill this capacity and capture the efficiency benefits of larger vessels has led to hasty decisions by carriers. In turn, profits have become exceptionally volatile. Record losses in 2009 were followed by strong profits in 2010―and significant losses again in 2011 (Exhibit 1).

Exhibit 1

Industry earnings are lower and more volatile.

The supply/demand imbalance, the larger vessels that will only make the imbalance worse, and the volatility of profits are significant problems. However we argue that they are in fact symptoms of these deeper challenges:

- The market is saturated, and the industry is now in a race for market share. The quest to take share is squeezing out smaller players and has started another wave of price wars. Shipping companies are forsaking their guidelines on pricing, both in spot rates and general rate increases, and choosing not to enforce contracts with customers.

- Companies are pricing at their marginal cost. That’s not necessarily bad; in fact, it’s the right decision for many. But for others it is irrational, and when everyone does it, the industry suffers. Many shipping companies have ineffective cost-management systems. When they use these to determine pricing, they are pricing at a fraction of full costs; fuel, for example, is only partially priced into many charters. In effect, companies are passing on all of the cost savings they have achieved in recent years to customers.

- Innovation in service offerings is sporadic. Most carriers offer the same or similar service to all customers, regardless of need. Carriers are missing opportunities to charge premiums for value-added services (for example, intermodal and guaranteed delivery times) and are unable to monetize innovations.

- Fleet changes have made network designs outmoded. Most companies’ networks do not adequately maximize profits. For example, the arrival of the new ultralarge container ships has already triggered cascading effects on smaller ships. Although feeder ships are benefiting from this trend, mid-size Panamax vessels and others have been squeezed out. This will have a significant effect on shipping lines, which carry a large portion of Panamax vessels on their balance sheet.

- Conflicts between asset managers and transportation companies are producing suboptimal business decisions.Many carriers are caught in conflicts with owners of ships they manage. Carriers want to manage the transportation business for profit; owners want to manage for maximum value of their assets. Many suffer from a conflict between the asset-management and transportation mind-sets. Without fundamental changes, such as industry consolidation or new external shocks, we see the trend of overcapacity and industry losses continuing for the next three to five years. We project that supply/demand imbalances will persist (Exhibit 2), with revenues and pricing remaining under pressure as larger vessels launch and global GDP grows only moderately.

Exhibit 2

Supply will likely exceed demand for some time; rates may slowly rebound.

Organizational challenges

Of course, executives are aware of many of the problems the industry faces. And most know the solutions—nothing we describe in this article will be earth-shattering for container-line executives. But getting their organizations to act on them is difficult. Shipping companies are deeply conservative; change comes only slowly. Many companies discount anything that is “not invented here.” One operations head found that an unconventional trim, one or two meters “by the head,” cut bunker consumption by 3 percent. But when captains and masters balked, the executive found no support elsewhere to drive his cost-saving idea. Most lines also have few analytical resources, either in the corporate center or the business units. Decisions are often undertaken and forecasts made with only a minimum of information, much of it often borrowed from external providers that also supply their competitors.

In part, the industry’s conservatism is born of a long history of boom and bust. These cycles make it difficult to provide meaningful performance-based incentives to executives and staff. But that hinders motivation; employees become uninterested in challenging the status quo or in making changes in the way they work.

Other problems crop up in companies’ structures. Most are organized by function, for good reason. But ensuring cooperation can be difficult when departmental budgets are involved. The maintenance organization pays for cleaning of hulls and propellers, but the resulting savings in fuel go to purchasing.

An agenda for greater productivity

Some of the challenges that companies face―the supply/demand imbalance, and swings in demand―are systemic, and beyond the ability of any one company to fix. But the rest are readily addressable. Container lines can and must deploy three sets of actions―commercial, operations, and network and fleet―to improve their performance. Taken together, these three elements typically improve a line’s earnings by 10 to 20 percent. Companies have a huge incentive to act first—once the whole industry has moved to a greater level of productivity, the benefits will likely be passed on to customers once again through competition. Several lines are already well advanced on the journey to greater productivity; smart lines can beat the competition by being quicker and more thorough in their implementation.

Commercial

In their marketing and sales, shipping companies need to shift from a cost-plus approach to one that emphasizes value. Lines should get paid full value for the services they provide. A comprehensive commercial program, covering the full gamut of commercial activities from pricing strategy to contracting strategy to uptake management, can deliver immediate bottom-line impact. In our experience, companies can improve return on sales (ROS) by 1 to 2 percent within 9 to 12 months.

The approach has many elements; three stand out. First, a “model ship” analysis can help carriers understand which customers contribute most to profits. One global container line used market information to develop its model. Based on this analysis, the company created targeted sales campaigns to pursue and capture high-contributing customers. The campaigns lifted ROS by about 2 percent in several regions and trade lanes.

A second element is better commercialization of “last mile” customer services, including detention and demurrage. Many shipping lines have made strides in this area, but more can be done. One global shipping line created a rigorous performance-management system to ensure accurate invoicing and expedited collection of detention and demurrage. It also standardized tariffs across different countries and trades. These two steps lifted detention and demurrage revenues by 15 percent.

Third, and perhaps most important, lines can improve their pricing discipline to ensure that they reap the full benefit of their value-selling approach. We see clear improvement potential for lines across all elements of the pricing process, from strategic pricing to transactional pricing to the systems and tools used to support the front line. Sometimes it is right to follow the market and price close to marginal cost to fill the ship. But lines need to identify the peaks in prices (they do happen, even in today’s oversupplied market) and the times that they have privileged capacity, and ensure that they are charging to capture both events. This requires building flexibility into contracting, so that in the peaks a carrier’s ships are not full of low-yielding cargo contracted at annual rates. Carriers can also extract higher prices from customers in certain industries, to whom smooth and reliable transport and the resulting stable inventory are quite valuable.

Operations

Even more than commercial levers, operational improvements are squarely in the shipping company’s wheelhouse; they are entirely under the carrier’s control. That makes them an excellent source of improvement in both profitable and unprofitable periods. And, given that many lines are already well down the implementation path, it’s an imperative for all. Three levers account for most of the costs and thus deliver most of the impact: bunker management, procurement, and asset utilization. The improvements we sketch out below can drive a five- to ten-percentage-point rise in earnings.

Bunker management. Rising fuel prices have made bunker the largest cost item for shipping lines, more than fleet or overhead, and often exceeding 40 percent of all costs. Fuel bills can be reduced in many ways, some well known (optimizing vessel speeds, more frequent hull and propeller cleaning), others less so (unconventional trimming “by the head,” inventory management). Lean terminal operations is one that many carriers overlook. Faster turnarounds in port save time, which ships can use to steam at lower speeds at sea. Ports can automate intermodal dispatch of both incoming and outgoing cargo and better integrate planning and IT systems with inland operators. That work falls mainly on port operators, of course, but shipping lines can make it happen through tough negotiations with competitive ports, service-line agreements that cement the deal, and guarantees of berth availability.

Finally, though bunker is a commodity, companies can achieve savings through better sourcing processes, drawing from a wider range of suppliers and using lower-quality fuels where available. Reducing bunker costs through these moves typically improves earnings by two to three percentage points. For example, one global shipping company optimized the hundreds of millions of dollars of bunker inventory it carries in the ships, saving about 3 percent of total bunker costs from just this one lever (Exhibit 3).

Exhibit 3

A new bunkering approach can yield savings.

Procurement. For most lines, the next biggest operations opportunity is in procurement. Beyond bunker, lines should be concerned with three other categories. First, terminal costs can be reduced. Negotiations with competitive port operators, as discussed above, will help in some cases; in others, greater use of requests for quotation (RFQs), and a clean-sheet analysis of ports costs, including accessorial fees, such as storage, security, handling, transshipments, and reefer monitoring can deliver savings. A few carriers are taking these moves a step further, and tightening their relationship with terminals. Colocated teams can jointly optimize operations; well-structured incentives and penalties can align interests.

The same analyses can also produce savings in intermodal costs (including feeder vessel hires), the second big category. Lines should understand suppliers’ costs for trucking, rail, and feeders, and use the information for advantage in negotiations. Market analysis can help lines know when prices are at their lowest and establish the correct pricing structure to reduce total cost of ownership. One global carrier rolled out a new online bidding system for trucking services in North America; it eased the system in with workshops for vendors. The initiative is now delivering savings of about 10 percent of intermodal costs.

Third, RFQs and similar approaches also work well in containers and logistics, at time of purchase and also in maintenance and repair. A review of the total cost of ownership can reveal some surprising anomalies; the container with the cheapest purchase price often costs the most in the long run. Companies can get more strategic by building price forecasts of dry containers, which can help them decide when to pull the trigger on new purchases and negotiate those in progress.

Asset utilization. Stowage planning and container-fleet management are crucial levers to optimize asset utilization. Done well, a company can even reduce its fleet. New software tools can help with stowage planning. A “cockpit” can help companies develop smart metrics and use them to guide the company. A target performance analyzer shows the deviation between planned and actual stowage. A move validator uses a heuristic to calculate the “right” number of crane moves for the given load, which can then be compared to the number of moves on the bill.

These tools must be combined with careful execution. Since stowage is a tension point between operations (which wants certainty) and commercial (which prizes flexibility), companies need to clearly define processes, handovers, cutoff times, and so on. Best-practice companies finalize their load lists two to three days before sailing and rely on solid forecasting and prediction systems, standard rolling processes, and exception-handling routines.

Network and fleet

Network and fleet improvements take longer than commercial or operational moves and require strategic timing. Two moves in particular can boost earnings by six to eight percentage points.

“Own or lease?” The question has long lain at the heart of container-shipping strategy. From our analysis, the industry typically relies too much on leasing. While leasing may be the only option for many cash-strapped liners that already have substantial debt, other lines should take advantage of this by owning more of their fleet. Leasing does provide a little more flexibility to change vessel deployment. But that breathing room often comes at too high a price.

Shipping lanes or “trades” provide another interesting test. Shipping lines must choose whether to deliver direct or transship at an interim hub. The decision depends on several factors such as size of ship and distance. The tradeoffs have changed with today’s larger vessels and expensive fuel. But lines have not always made the necessary changes to their networks.

Leading lines are building new network tools to solve these knotty challenges.

Making it happen

As they take up the complex agenda outlined above, lines will also want to make changes to their organization that will give them the best chance for success. Five tactics can help a container-shipping line unleash its full potential.

- Build cross-functional teams. Teams that bring together critical functions make better decisions on the trade-offs facing carriers. For example, one global line recently established an exception-management team with representatives from operations and commercial. Its mandate is to decide tricky questions that come up in vessel operations. Should a vessel speed up to get to Hong Kong and take on transshipment cargo, or should it skip the port and sail at a lower speed? The exception-management team considers both the commercial and operational impact and makes the right choice for the company.

- Challenge the legacy. Companies can shake things up by bringing in new and controversial points of view. External experts can challenge established practices. Companies must innovate; a systematic approach to finding and testing new ideas can help. Innovation is possible across the enterprise, in products and services, the organizational and business models, and especially in the digitization of key operational processes. It is not too far-fetched to imagine that within three years, new technology start-ups can develop a superior, data-based understanding of cargo flows to threaten container lines. Already, new IT-enabled businesses are making inroads into logistics and freight-forwarding markets; others aim to automate processes for ocean-freight booking and invoicing. In anticipation, leading carriers are investing in devices and software to track containers in real time. At a minimum, all carriers need to monitor developments in this space.

- Create a performance culture. Programs to transform business practices may start strong but typically fade after a few months or years. To sustain the improvement, shipping lines must build a rigorous and regular performance-management system. Weekly dialogues can improve transparency and help senior managers make more informed decisions.

- Redesign incentives. Employees need both monetary incentives and recognition to energize a transformation journey. We have helped the transformation leaders of global shipping companies think through incentive program design and rollout. Programs can include new key performance indicators and bonus pools in addition to recognition awards and ceremonies. It is important to balance the right mix of monetary and nonmonetary incentives to achieve the desired behaviors.

- Invest in analytics. Dedicated analytics teams can help senior managers understand the financial impact of both high-level issues including corporate strategy and pricing. Analysts can also help with tactical issues including network design (utilization, vessel deployment, string strategy); terminal productivity (port bottlenecks, terminal operations); bunkers (speed profiles of vessels, optimal speeds), and market intelligence and forecasts (industry-wide utilization on given trades, rate trends, mid- and long-term outlooks). Automatic identification system (AIS) data can be invaluable to the analytics team; some leading shipping lines are developing AIS-based models of utilization and other measures of productivity.

Container shipping has come through five highly volatile and unprofitable years, but remains in poor health. We expect the challenges to persist, especially with new capacity coming online, but argue that container-shipping lines must not give up in the face of market adversity. They can and must launch comprehensive transformations that addresses technical issues and organizational and mind-set challenges. This is the only way to stay a step ahead of competition and achieve elusive profitability.

About the authors

Timo Glave is an associate principal in McKinsey’s Copenhagen office; Martin Joerss is a director in the Beijing office, where Steve Saxon is a principal.

The authors wish to thank John Chen for his contribution to this article.